While most people only associate Hawaii with endless beaches and a warm climate, they don’t often consider the amount of traffic in this island state. With each vehicle on the road using approximately five quarts (1.25 gallons) of motor oil at a time, the amount of used motor oil generated annually adds up to millions. Combined with other sources of waste oil, you can easily see the importance of understanding Hawaii’s used oil laws and recycling incentives.

Additionally, paying to dispose of waste oil can be prohibitively expensive on an island. For instance, the Naval Facilities Engineering Command Hawaii was paying up to $2.50 per gallon to remove and dispose of their waste oil. Collecting over 200,000 to 400,000 gallons annually, the organization was paying up to $1 million each year.

Used Oil Recycling Laws In Hawaii

Used motor oil contains toxic substances that can contaminate land, groundwater, and the ocean. As a result, Hawaii has established used oil recycling laws for residents and businesses to protect these natural resources and the individuals who rely on them. These laws cover how to legally collect, dispose, store, and burn waste oil.

Waste Oil Disposal

All waste oil must be disposed of properly. For those operating in any commercial industry, used motor oil generators may only dispose of used oil using a state-permitted service. Companies with state permits for transporting oil vary by island, but many offer pickup services. They may not use household drop off centers for large quantities of waste oil.

Residents may take up to 4 gallons of used oil to a registered used oil collection site. Additionally, the oil must be in a lidded container with a pourable spout. Buckets or pails are not permissible. Using bleach, antifreeze, or pesticide containers is also prohibited. Furthermore, the oil can not be mixed with any other substance. Acceptable types of waste oil include motor oil, gear oil, shock oil, hydraulic oil, transmission oil, and diesel oil.

Waste Oil Collection Facilities

All organizations that market themselves as oil collection facilities in the state must maintain a permit for managing used oil. Additionally, they must comply with all relevant generator standards. Many of the laws enforced at the state level mirror regulations enforced at the federal level. If and when organizations change their used oil management policies, they may want to consider updates and changes to current state and federal laws. Failing to comply with regulations can result in penalties.

Burning Waste Oil

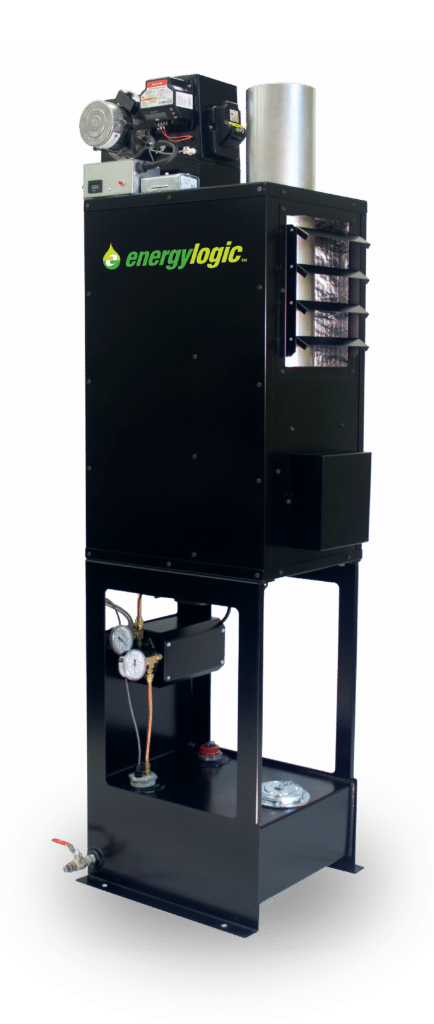

Under Chapter 11-279 of Hawaii Administrative Rules, all waste oil burned for energy recovery purposes must meet state regulations for allowable levels of contaminants, including lead, arsenic, cadmium, and halogens. Any person or business that stores used oil onsite must also comply with storage unit regulations. All owners must keep oil storage containers in good condition and take immediate action to remedy used oil leaks and spills if and when they occur. Organizations and individuals using waste oil for energy recovery in burners must only use self-generated oil or oil from DIYers.

Hawaii Waste Oil Incentives to Consider

Hawaii doesn’t offer a specific waste oil incentive program. However, there are still a couple of benefits a business can apply for that will reduce the costs associated with installing a waste oil heater. The first to consider is Hawaii Energy. Hawaii Energy is an environmental conservation and energy efficiency program in the state that administers energy rebates. While the program primarily offers specific incentives for certain projects, it also allows businesses and individuals to come forward with customized projects.

The program may support automotive businesses and other waste oil generators that want to invest in high-efficiency waste oil burning systems and fans. Any technology that will save energy is considered and evaluated case-by-case. The custom rebates are based on projected energy savings for new or retrofit projects. The project must be pre-approved before energy purchase.

The second to consider is a property tax exemption. In 2009, Honolulu passed Bill 58 to create a major property tax exemption for individuals and businesses that invest in alternative energy improvements. Under the bill, high-efficiency waste oil burning systems may qualify. According to the bill, land with alternative energy installations qualifies for a property tax exemption for 25 years. Companies interested in taking advantage of this incentive for a waste oil burner project may want to discuss eligibility with a local tax professional.

Waste Oil Burning Systems Simplify the Waste Oil Management Process

Burning waste oil on-site doesn’t cost businesses anything. Additionally, modern, high-efficiency systems comply with both state and federal standards for oil burning. While Hawaii may offer only limited incentives for recycling used oil, companies can make the waste oil management process simpler and more cost-effective by installing a waste oil heater or boiler.

Sources:

https://data.hawaii.gov/Economic-Development/Motor-Vehicle-Registration-Trend/i6gp-tvm3/data

https://hawaiienergy.com/for-businesses/incentives/customized-projects

http://health.hawaii.gov/shwb/files/2015/05/11-279.pdf

http://health.hawaii.gov/shwb/files/2015/08/Used-Oil-Haulers-and-Recyclers-072016.pdf