Does your business generate used oil? Have you considered purchasing a high-efficiency used oil burning system? If so, it is worth exploring what financial incentives are available for investing in alternative energy solutions. Unfortunately, Montana businesses won’t find a waste oil incentive for their installation. However, they may find a few incentives that make the investment worthwhile. Learning more about these incentives, understanding Montana’s used oil laws, and investing in a used oil heating and cooling system can all help with waste oil management.

Financial Incentives for Investing in Alternative Energy Solutions in Montana

Investing in alternative energy solutions, can benefit the bottom line of a Montana business. Through government incentives and reduction in energy bills, there are a couple of solutions to consider.

First, Montana offers one significant financial incentive for investing in alternative energy solutions: The Energy Conservation Investment Deduction. The Energy Conservation Investments Deduction allows businesses to deduct up to $3,600 for capital investments in buildings for the purpose of conserving energy.

Additionally, depending on the pollution control solutions built-into the used oil burner, businesses may also qualify for a tax credit under tax code Section 45Q: The Carbon Oxide Sequestration Credit. The amount of the credit depends on when the qualifying capture equipment was put in service and how many metric tons of CO2 were captured.

Note: Businesses interested in exploring if these tax deductions and credits are applicable to their situation, should always check with a local tax professional. Businesses may also find additional incentives through federal programs and nonprofit conservation organizations.

Finally, investing in a high-efficiency used oil heating and cooling system can save a business hundreds of dollars every year. Depending on the size of the space and the size of the solution, some companies may save close to a thousand dollars annually.

While financial incentives help, businesses must consider the total cost vs. benefit of transitioning to an alternative energy system.

Montana Laws Regarding Used Oil

Montana enforces similar regulations as other states regarding the management of waste oil. To begin with, both federal and state laws prohibit dumping used oil into the environment. Instead, anyone who generates waste oil should take steps to properly contain it and either dispose of it in an appropriate manner such as through an approved collection center.

Additionally, any organization that produces waste oil must keep and maintain storage containers labeled as “used oil.” According to state regulations, used oil generators include automotive repair shops and service stations, trucking industry fleet management service shops, and commercial driving and delivery companies.

However, Montana does allows recycling of waste oil through an approved waste oil burning systemIn most heaters, businesses must restrict their burning activities to self-generated used oil, oil collected from DIYers, and tested oil that meets the approved range of common contaminants.

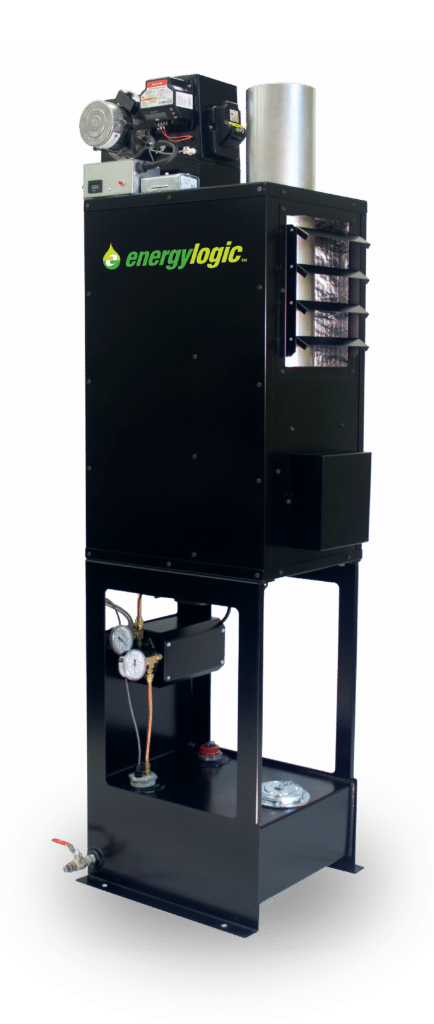

Investing in Used Oil Heating and Cooling Systems

Since recycling large quantities of oil according to regulatory guidelines often takes time and money, many businesses today search for legal alternatives to recycling programs. Waste oil heating and cooling systems offer a way for businesses to dispose of used motor oil and generate energy for free. High-efficiency systems often perform better than conventional HVAC systems and provide enough energy to keep thousands of square feet of garage space at a comfortable temperature throughout the day. As a way to cut energy costs and simplify the used oil management process, oil based heating and cooling systems can make sound business sense to many used oil generators.

Sources:

http://deq.mt.gov/Portals/112/Land/hazwaste/documents/40_CFR_279_11.pdf

https://deq.mt.gov/twr/Programs/usedoil

http://deq.mt.gov/Land/HazWaste/hazUsedOil

http://mainstreetmontanaproject.com/Portals/44/Montana%20Tax%20Climate%20and%20Incentives.pdf