As Idaho allows businesses to burn waste oil for energy recovery, installing a waste oil burning system can save a business thousands of dollars over the equipment’s lifespan.

Every Idaho resident must comply with federal and state regulations when it comes to waste oil management. These rules apply regardless of a business’s or individual’s location or the amount of waste oil produced. Understanding how to store and properly dispose of waste oil can help organizations make the most of used oil management. These suggestions can help companies plan accordingly.

Offsetting the Costs of Waste Oil Heating and Cooling Systems

Unfortunately, Idaho doesn’t have incentive programs for waste oil recycling or recycling equipment. However, it does allow businesses to receive a 3% investment tax credit for purchasing new depreciable equipment used in the state. The investment tax covers depreciable assets, including equipment and machinery, other tangible property, and petroleum storage facilities. In many cases, a waste oil heating and cooling system qualifies for the tax credit.

A local tax professional can confirm if a high-efficiency waste oil heating and cooling system qualifies for Idaho’s 3% Investment Tax Credit for your business. If so, the credit combined with the energy savings associated with high-efficiency technology, make investing in alternative energy very appealing.

Idaho State Regulations Regarding Waste Oil

Like most states, Idaho’s used oil laws mimic the federal EPA standards for managing used oil. Every oil generator in the state, from the DIY car owner to trucking companies, must adhere to the same set of standards. These regulations include storing used oil in watertight containers, properly labeling all containers filled with waste oil, maintaining the condition of all waste oil containers, and effectively managing any spills. Additionally, all used oil generators must take steps to minimize waste.

The importance of adhering to these regulations can not be overstated. Even one quart of oil can contaminate 250,000 gallons of potable water, and used oil containing hazardous properties can cause serious health problems for humans. Additionally, when organizations and individuals fail to comply with oil management standards, they may face state and federal penalties.

Using Waste Oil as Fuel in Idaho

Many residents use waste oil as a fuel source for energy recovery in Idaho. As long as waste oil burning practices comply with applicable regulations, waste oil heating and cooling systems can provide free energy. Additionally, using waste oil as fuel in Idaho can reduce the costs associated with legal disposal methods.

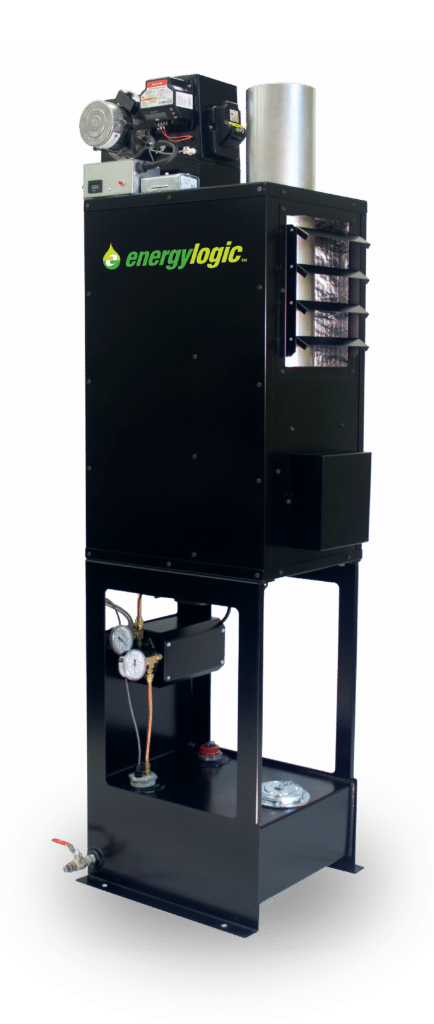

High-efficiency waste oil burning systems allow users to enjoy a higher BTU output without worrying about environmental pollution. The system burns off all contaminants and minimizes the number of by-products released into the air during burning. Owners of these systems enjoy savings on energy bills during cold winters and can better maintain the comfort level of work bays and garages throughout the year.

Benefits of Energy Recovery Through Waste Oil Burners

Organizations that retrofit their service departments and garages with high-efficiency used oil burners can start capturing the full value of the resources at their disposal. As the price of oil fluctuates, many recycling organizations are starting to charge for their services. When companies can reuse the waste oil they generate, they can eliminate the hassle of scheduling pick up services. Cutting-edge systems also deliver impressive heating and cooling results for 9,000–10,000-ft2 spaces. Compared to conventional annual heating costs, a waste oil burning system can save businesses thousands of dollars over the years.

Sources:

http://www.deq.idaho.gov/media/532485-burners_of_off_specification_used_oil.pdf

https://tax.idaho.gov/forms/EFO00030_05-10-2013.pdf

https://www.deq.idaho.gov/waste-management-and-remediation/hazardous-waste-in-idaho/used-oil/

https://www2.deq.idaho.gov/admin/LEIA/api/document/download/3276